Introduction

In this blog, we will explore the 7 common reasons why fintech start-ups fail and how to avoid them. Whether you are just starting out or already have a fintech business, it is important to understand these pitfalls and take steps to avoid them in order to increase your chances of success. But first, let's look at why now is the right time to invest in fintech.

As the fintech industry continues to grow and evolve, more and more entrepreneurs are launching start-ups in this exciting and innovative space. While there is no shortage of opportunities for fintech start-ups to succeed, the reality is that many of these businesses will ultimately fail.

In this blog, we will explore the 7 common reasons why fintech start-ups fail and how to avoid them. Whether you are just starting out or already have a fintech business, it is important to understand these pitfalls and take steps to avoid them in order to increase your chances of success. But first, let's look at why now is the right time to invest in fintech.

-

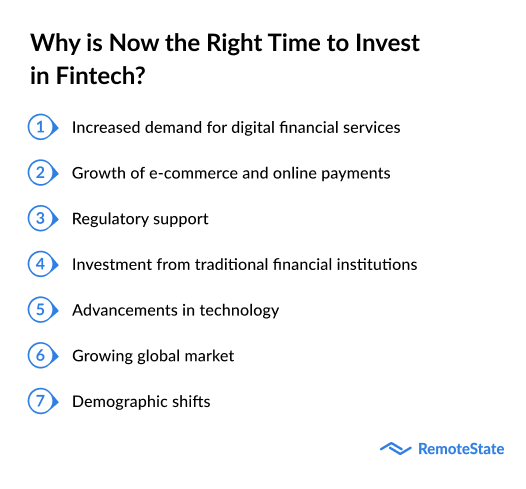

Increased demand for digital financial services: The COVID-19 pandemic has accelerated the shift towards digital financial services, as many consumers and businesses have had to rely on online banking, mobile payments, and other digital options due to social distancing measures. This increased demand for digital financial services presents a significant opportunity for fintech companies to grow and expand their reach.

-

Growth of e-commerce and online payments: As more and more consumers turn to online shopping, the need for secure and convenient payment methods has also increased. This has led to the growth of fintech companies that specialize in online payments and e-commerce solutions.

-

Regulatory support: Many governments around the world have recognized the importance of fintech and are taking steps to support the industry. This includes providing regulatory frameworks that allow fintech companies to operate and innovate, as well as initiatives to promote financial inclusion and access to financial services.

-

Investment from traditional financial institutions: Traditional financial institutions are increasingly turning to fintech to improve their operations and stay competitive. This includes making strategic investments in fintech companies, as well as partnering with them to develop new products and services.

-

Advancements in technology: The rapid pace of technological advancement has made it possible for fintech companies to develop innovative solutions that were not previously possible. This includes the use of artificial intelligence, machine learning, and blockchain, which have the potential to disrupt and transform the financial industry.

-

Growing global market: Fintech is a global industry with significant growth potential. Many countries around the world are seeing an increase in fintech adoption, which presents opportunities for fintech companies to enter new markets and expand their reach.

-

Demographic shifts: Changing demographics, such as the rise of younger, tech-savvy consumers, are driving demand for fintech solutions. This presents opportunities for fintech companies to develop products and services that meet the needs and preferences of these consumers.

Why Do Fintech Businesses Fail and How to Make Your Fintech Startup a Success

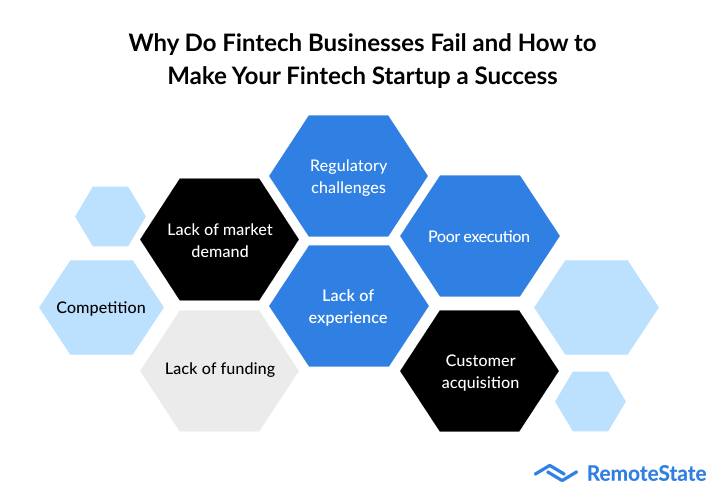

Despite the promise of innovation and disruption, many fintech businesses struggle to thrive in the highly competitive financial industry. Fintech businesses face a number of challenges that can ultimately lead to their demise. Some of the most common reasons for fintech businesses failing include

1. Lack of market demand

1. Lack of market demand

One of the most common reasons why fintech start-ups fail is due to a lack of demand for their product or service. Many entrepreneurs are driven by their own personal passions and beliefs and may develop a product or service that they think is innovative and game-changing. However, if this product or service does not align with the needs or wants of the target market, it is likely to fail. This is particularly relevant in the fintech industry, where the demands and preferences of consumers are constantly changing.

To avoid this pitfall, it is important to conduct thorough market research before launching a fintech start-up. This should include gathering data on the size and demographics of the target market, identifying any unmet needs or pain points, and assessing the level of competition in the space. By understanding the market and its needs, fintech start-ups can create products or services that are more likely to resonate with their target audience.

2. Lack of funding

Another major factor that can contribute to the failure of fintech start-ups is a lack of funding. Starting a business requires significant capital, and without sufficient funding, it can be difficult to get off the ground. This can be especially challenging for fintech start-ups, as the costs associated with developing and launching new technologies can be high. Many start-ups rely on venture capital or angel investors to provide the necessary funding, but these sources can be hard to come by, particularly for companies that are still in the early stages of development.

To avoid this pitfall, it is important for fintech start-ups to have a solid funding strategy in place. This may include seeking out grants, loans, or other sources of financing, as well as developing a clear plan for how the funds will be used. Fintech start-ups should also be proactive in seeking out investors, and be prepared to clearly articulate their value proposition and business model in order to attract funding.

3. Competition

Fintech is a highly competitive industry, with a large number of start-ups vying for a share of the market. This can make it difficult for new companies to stand out and differentiate themselves from their competitors. As a result, many start-ups struggle to gain traction and may ultimately fail due to a lack of market share.

To avoid this pitfall, it is important for fintech start-ups to have a clear value proposition and unique selling points. This may include offering a unique product or service, leveraging innovative technologies, or targeting a specific niche within the market. Fintech start-ups should also be proactive in building partnerships and relationships with key players in the industry in order to gain credibility and exposure.

4. Regulatory challenges

can also be a major obstacle for fintech start-ups. The financial services industry is heavily regulated, and new companies must navigate a complex web of rules and regulations in order to operate legally. This can be a daunting task, particularly for start-ups that are still in the early stages of development. Moreover, the regulatory landscape is constantly changing, which can make it difficult for start-ups to keep up with the latest requirements.

To avoid this pitfall, it is important for fintech start-ups to familiarize themselves with the regulatory environment and ensure that they are in compliance with all relevant laws and regulations. This may include obtaining necessary licenses and permits, as well as seeking out legal guidance and advice. Fintech start-ups should also be proactive in staying up-to-date on any changes to the regulatory landscape, and be prepared to adapt their business model accordingly.

5. Lack of experience

can also be a factor in the failure of fintech start-ups. Many entrepreneurs are drawn to the fintech industry because of its potential for disruption and innovation, but they may not have the necessary knowledge or expertise to navigate the complex and constantly evolving financial services landscape. This can lead to costly mistakes and ultimately result in the failure of the start-up.

To avoid this pitfall, it is important for fintech start-ups to surround themselves with experienced professionals who can provide guidance and support. This may include hiring advisors, mentors, or consultants who have a deep understanding of the fintech industry and can help the start-up navigate its challenges. Fintech start-ups should also be proactive in seeking out opportunities for learning and professional development, such as attending industry events or enrolling in relevant training programs.

6. Poor execution

Even with a strong business plan and a solid product or service, start-ups can still fail if they are unable to execute effectively. This can be due to a variety of factors, including poor management, a lack of focus, or an inability to scale the business. Fintech start-ups, in particular, may struggle with execution due to the complex nature of the financial services industry and the need to adhere to strict regulatory requirements.

To avoid this pitfall, it is important for fintech start-ups to have a clear vision and strategy, and to stay focused on their goals. This may involve setting specific milestones and targets and regularly reviewing progress to ensure that the business is on track. Fintech start-ups should also have a strong management team in place, with individuals who have the necessary skills and experience to lead the business.

7. Customer acquisition

Acquiring new customers can be a major challenge for fintech start-ups, particularly if they are entering a crowded market or competing against well-established players. Many start-ups struggle to generate awareness and interest in their products or services, which can make it difficult to attract and retain customers. This can be particularly frustrating for start-ups that have developed innovative and valuable products but are unable to effectively reach their target market.

To avoid this pitfall, it is important for fintech start-ups to have a clear marketing and sales strategy in place. This may include identifying target audience segments, developing targeted marketing campaigns, and leveraging social media and other digital channels to reach potential customers. Fintech start-ups should also focus on building strong relationships with their customers and be proactive in soliciting feedback and addressing any concerns or issues that may arise.

Fintech start-ups face a range of challenges and obstacles that can ultimately lead to their failure. By understanding these common pitfalls and taking steps to avoid them, fintech start-ups can increase their chances of success and position themselves for long-term growth and sustainability.

Finishing Up!

In conclusion, Remotestate is a software development company that can help fintech startups do better in a number of ways. By leveraging the latest technologies and approaches, Remotestate can help fintech startups build custom software solutions that are tailored to their specific needs and goals. Whether it's developing a new financial application, integrating with existing systems, or optimizing existing software, Remotestate has the expertise and experience to deliver results.

Additionally, Remotestate can provide ongoing support and maintenance services to ensure that fintech startups are able to continuously improve and optimize their software solutions. With its focus on collaboration and transparency, Remotestate is a partner that fintech startups can rely on

Publication Date

2023-01-10

Category

Fintech

Author Name

Sajal Nehra